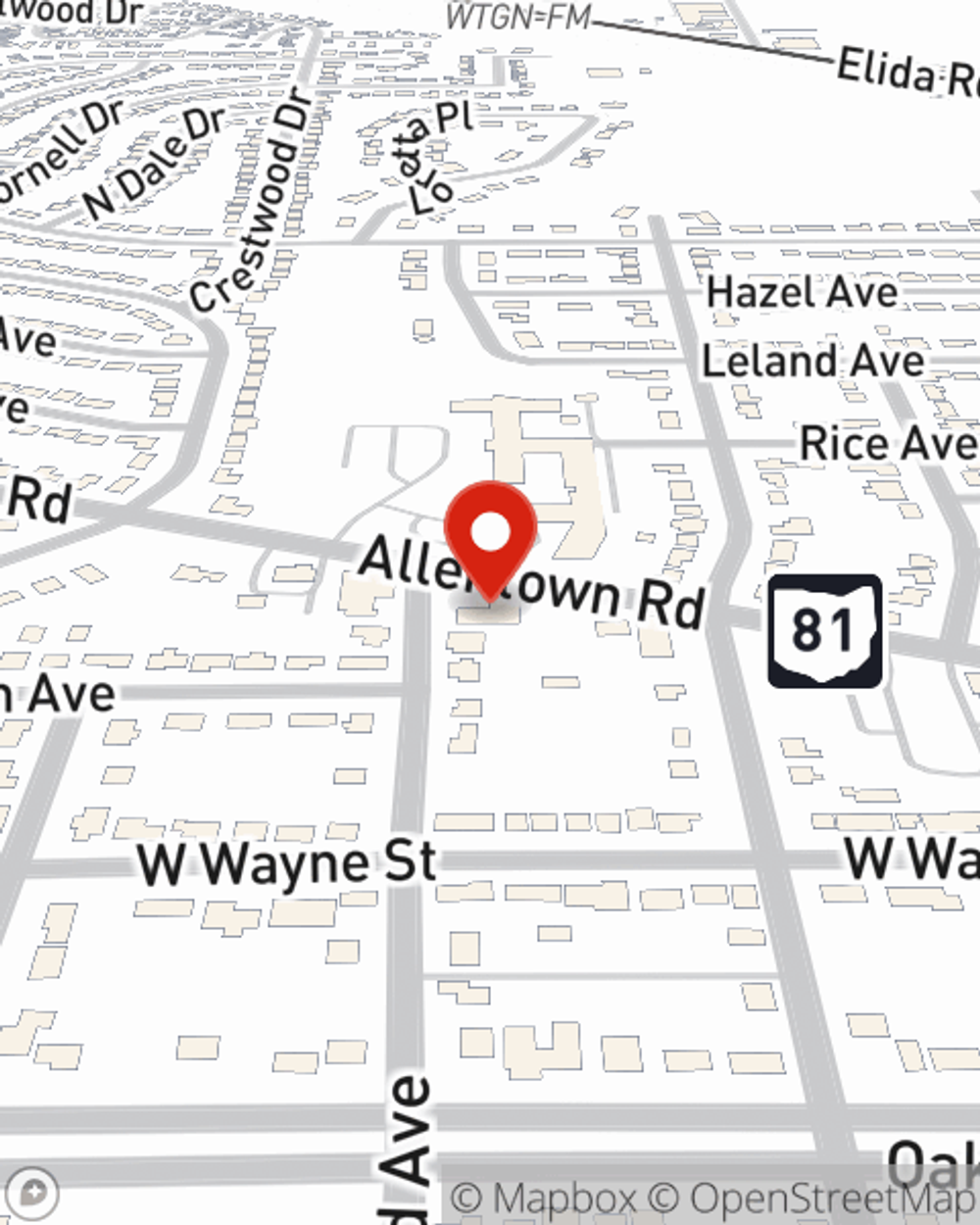

Business Insurance in and around Lima

Searching for coverage for your business? Search no further than State Farm agent Lori Kroeger!

Helping insure businesses can be the neighborly thing to do

- Lima

- Delphos

- Columbus Grove

- Spencerville

- Elida

- Fort Jennings

- Ottoville

- Bluffton

- Ottawa

- Van Wert

Insure The Business You've Built.

You may be feeling like there is so much to do with running your small business and that you have to handle it all alone. State Farm agent Lori Kroeger, a fellow business owner, can relate to the responsibility on your shoulders and is here to help you put together a policy that's right for your needs.

Searching for coverage for your business? Search no further than State Farm agent Lori Kroeger!

Helping insure businesses can be the neighborly thing to do

Customizable Coverage For Your Business

Whether you are a pharmacist a veterinarian, or you own a clothing store, State Farm may cover you. After all, we've been doing it for almost 100 years! State Farm agent Lori Kroeger can help you discover coverage that's right for you and your business. Your business policy can cover things such as buildings you own and equipment breakdown.

Reach out to the excellent team at agent Lori Kroeger's office to explore the options that may be right for you and your small business.

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Lori Kroeger

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.